Since our childhood we are always taught we should work hard to earn more and live lavish lifestyle- though the theory looks good, there's always a limit on how much one person can work- if we're aiming higher- at one point of time- we should Bet on other people's success which brings us to our today's discussion

What is Multibagger stock?

As per Wikipedia, A multibagger stock is an equity stock which gives a return of more than 100% in a period of time, literally like you're investing one bag of money and taking two bags.

Why don't everyone invest in Multibagger stock

Wish that's easy, But there's two problems

- You don't know which are the Multibagger stocks: Unless you're The Big Bull you don't really know which stocks are gonna be future Multi-baggers, All you know is past and present data of which company stocks are exponentially increasing

- High Risk: Consider you want to bet on current Multibaggers itself, there's always high risk involved which makes people not invest in the stock

What Exactly is the risk in investing in Multi-bagger stocks

Market Manipulation

What Harshad Mehta does to Polo and other favourite stocks is Market Manipulation

As per Investopedia, Market manipulation is the act of artificially inflating or deflating the price of a security or otherwise influencing the behavior of the market for personal gain

It involves Corporates and Top HNIs investing lot of money in a single stock, spreading positive news through social media, and finance specific media in order to inflate the value of the stock in short term and after which selling stock after it reaches a higher peak to increase money in folds.

Its common practice and followed from 1970s till now.

What's negative with Market Manipulation

The Major problem with Market Manipulation is its unlikely that the stock value remains same or increases after a period of time, since its artificial inflation, there exists a situation where stock has to correct its value to stable figure.

While common people who see the stock rising day by day invest somewhere in middle of growth after it had witnessed significant growth, but the stable value of stock has higher probability to be much below the value retail investors buy in, thus resulting in huge loss.

Upper and Lower Circuits

Upper Circuit/Lower Circuit – The exchange sets up a price band at which the stock can be traded in the market on a given trading day. The highest price the stock can reach on the day is the upper circuit limit, and the lowest price is the lower circuit limit.

Effectively upper circuit is maximum value stock can trade for the given trading day and lower circuit is lowest value. This is done so that stocks doesn't act like cryptocurrencies fluctuating 100% in a day causing huge losses or artificial gains.

What happens when Market is Manipulated is that after a certain growth (say 50% from a value market manipulation is started) retail investors will not be able to buy the stock as at start of the market time for retailers, Corporates would have increased value to upper circuits. (Further buying stock will raise the stock value beyond upper circuit which is not allowed)

Similarly, when the stock is going down, it will hit lower circuit everyday thus not allowing you to sell, by the time it doesn't hit lower circuits everyday, value of stock would have decreased a lot more than what you've invested in thereby taking huge losses you've to exit the stock.

How to Minimize Risk while Aiming for Multibagger stocks

While the Above market manipulation need not happen for all Multibagger stocks, but there's always a chance of market correction. So Best to way to minimize risk yet aim for Multibagger stocks is Mutual Fund.

This is one of the Mutual Funds that I've invested in, Although the gains aren't astronomically high, 25% in 3 months is still very very high in Mutual funds.

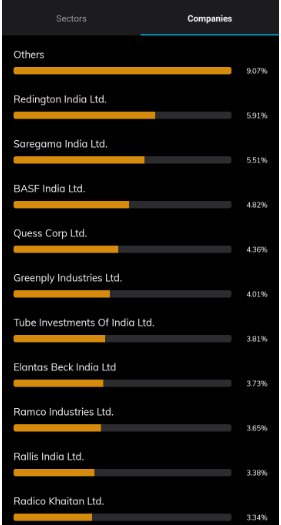

Let's looking at the companies the fund is investing on

As its small cap mutual fund, it focussed on small cap stocks (relatively lesser capitalization)

Picking one of the stock (Saregama India Ltd), let's see its growth

That's 7.2x growth in an year with very high consistency, thus as mutual fund has invested on lot of such stocks, its able to give very high returns. If done in stocks directly, there's always risk of losing money due to lower circuits after market manipulation

How's it risk free in Mutual Funds

One important point to remember is you can always the exit mutual fund whenever you want (except for tax saving mutual funds where there's 3 year mandate)( but you might have to pay exit load) so if the mutual fund going lower day by day, you can easily exit thus eliminating risk.

How's this possible

Mutual funds buy and sell stocks during pre-opening session (9:00-9:08 am ) much before the market session thus they can sell the stocks before it hits the lower circuit.

Additionally Mutual funds change their holding as and when required thus minimizing the loss

Isn't X a Great Alphabet?

0 Comments