Mutual funds is the one of the most common among this generation similar to Fixed deposit in last generation. Here's Detailed information on the Income tax on Mutual funds.

- Type of Fund

- Whether the Profit is long term or Short Term

1. Major Types of Fund for Income Tax calculation

There are in General only 2 types of fund

1. Equity Fund

- ELSS or Tax savings mutual funds are also considered as equity mutual funds

2. Debt Fund

- International Mutual Funds irrespective whether its Equity or other internationally is considered as Debt Funds in India

2. Mutual Funds based on Holding Period

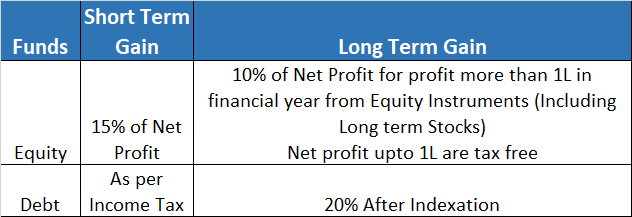

Calculating the Income Tax for Mutual Fund gains

Few points to be noted- Only Net profit from the Mutual Funds are taxed irrespective of whats the amount deposited, withdrawn, NAV, Platforms used etc

- Profit/loss is only when you have sold your mutual funds, The current holding mutual profit/loss is called unrealized profits or loss which are not taxed

- Only Net Profit from sold mutual funds for financial period- Net Profit should be calculated as Profit- Loss, If its overall loss, losses are not taxed.

- Profit of Mutual Funds is taken for respective financial year- Suppose you invested in 2010 and took out in 2015, Net Profit is taken for 2015 and not average of 5 years.

Suppose You have invested 10L in equity mutual funds and made profit of 1.5L in the financial year. 50k (Over the 1L) is taxed at 10%, so overall income tax is 5K, But if your profit is just 1l or less, your profits are tax free.

Debt Mutual Funds Taxation Explained

What is Indexation in Debt Mutual Funds

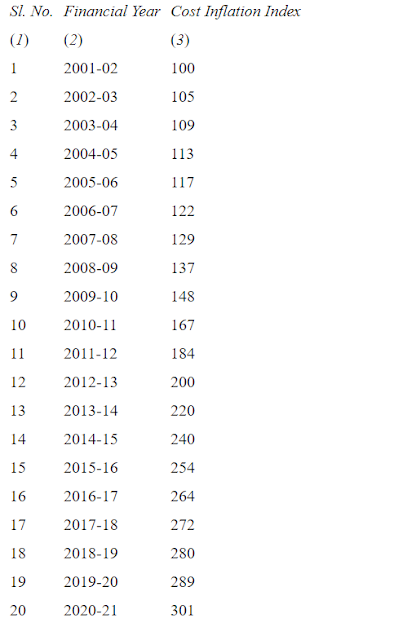

Indexation is method of factoring out Inflation from Net profits

Effectively Long Term Gain profit from Debt Mutual Funds= Net Profit * (Cost Inflation Index during the year invested/ Cost inflation index during the year you withdrawn the share)

This Long term gain profit is taxed at 20%.

Here's the Cost Inflation Index by Govt of India.

Let's take an example

You invested 1L in 2014 (CII was 240), Took it out in 2019 (CII of 289).

You made profit of 40K, So net Profit= 40,000* (240/289)= 33,217

Income Tax for this is 33,217*20%= 6,642

Income Tax on SIP

Income Tax on Mutual Funds Dividends

If you have any questions, Please drop comment, If you want our help regarding the IT Returns, contact us- charges applicable.

0 Comments